How to Budget Your Money

If you want to become a financially sound individual, you have to understand the importance of a quality budget. A budget will keep you on track for the type of lifestyle you want to live and, hopefully, prevent you from overspending.

Whether you decide to create a budget to save for a dream vacation, pay off bills, or free up more money for investments, it’s essential to stick to your plan. Below, we discuss a few key steps on how to create a budget for your lifestyle.

Figure Out Expenses

At the beginning of each month, that beautiful little surprise turns up in your bank account - the paycheck. It's easy to look at all this money and think, "wow, I made so much! I can buy whatever I want!" - trust me, I do it every month. But it's extremely important to get into the habit of looking at your paycheck as what is left over once you've paid your expenses.

What are expenses? Simply put, it's the money you spend. The key to getting a good understanding of your expenses is start with the payments that stay the same every month: rent, utilities, subscriptions, health care, insurance, and the like. Figure out each month how much of your income goes directly to these payments, so that you can clearly see how much money is actually available to spend.

Next, let's tackle other expenses. This is everything else you spend money on, and yes I mean everything. From coffee to groceries, nights out to travel costs, the more detailed of a picture you have of your spending, the more control you have over your finances.

Trying to figure out how much you buy or even what you buy can be daunting, but it's not that hard. If this is your first time budgeting, take a month or a couple weeks to observe and record how much you spend on averge and what types of things you spend on. It can be helpful to keep the receipts from your shopping, so you can cleary see what you buy, when you buy it and how much you spend.

Once you have collected this data, use tools like Google Sheets, or Exel to create a organized document of all your expenses, seperating them into categories such as fixed (rent, insurance, etc.), recurring (groceries, entertainment), non-recurring (one time payments such as buying a car), and whammies (big, unexpected expenses, like emergency surgery, or damage to a home). It's important to add a little extra wiggle room in your expenses for emergencies, or whammies.

At the end, you should have a number that represents your average monthly expenses.

Determine Your Income

Once you have your expenses, the next step is to determine your income. This may seem like a no-brainer but more often than not, people don't have a clear understanding of their income, especially if your income changes from month to month. For example, employees whose income comes largery from commission may have a harder time budgeting if they cannot forcast their income reliably.

An easy way to do this is to look at your annual income after tax from the previous year. It's important to make sure you're including all forms of income, not just the biggest one. That means including any extra funds you receive besides your annual income, such as cash gifts, alimony, interest, investment earnings, and rental income.

Do your best to come up with an accurate number for you income, so that you're not overreaching your budget because of a mistaken decimal point.

Set Goals

The only way to work towards the finances you want, is to set a goal and come up with a game plan. Set your sights high, but remain realistic and keep your lifestyle in mind. You're not going to become a CEO or mogul over night, but with organization and dedication, you get can the most out of your income and work towards a better future.

As we mentioned above, you may be saving for an engagement ring, a car, or a dream vacation. Whatever your motive is, set a goal, and then determine how much you can set aside to save for that goal. Make sure it’s a reasonable amount—you must continue to pay attention to your expenses and monthly needs.

Track Your Spending

This step can make or break your budgeting success. As mentioned above, budgeting only works if you have a clear and realistic understanding of your expenses. Spending $3.50 a day on a coffee can seem miniscule, but quickly adds up to almost $60 a month. Keeping track of things like this in your budget is paramount for achieving your financial goals.

Have you decided you want to save $100 a week? Now you can easily look into your non-essential expenses as see what you can cut out in order to save. Maybe it means getting rid of a Netflix subscription and only making coffee at home. This tactic makes it easy to understand your spending habits and also interrogate what you spend on and what value it brings to your life.

Adjust Habits

Once you start tracking your spending and understanding your habits more, you become equipped with the knowledge to take control of your life. It's harder to say no to purchasing something when you don't understand what you might be taking money away from.

A new sweater for $50 probably doesn't sound like very much, but if you know you only need $200 more to go on that vacation you've been saving for, you might think twice. This not only helps you towards your goals, but gives you a sense of confidence, knowing you are in charge of your life.

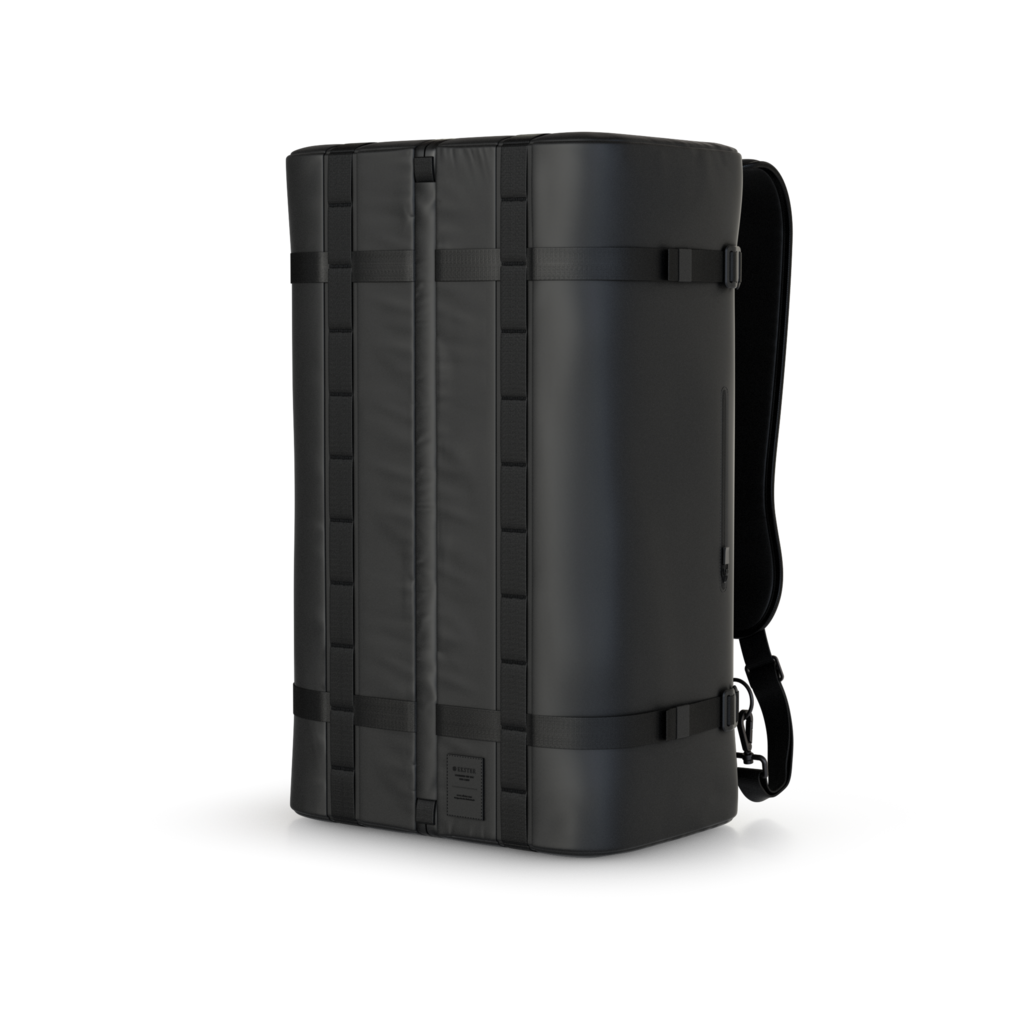

It's also helpful to invest in smart products that help alligns your habits with what you want them to be. Do you notice that you spend more money when you have cash instead of just cards?

You can adjust that habit by investing in a small chip wallet that only has space for credit cards. The more you notice, and the most honest you are with yourself, the easy it is to create habits that optimize your life and finances.

Continue Budgeting

People often create budgets but then don’t follow through with it as the months go on. One of the most important things you can do to live the lifestyle you deserve is to follow through.

Don’t stop budgeting after a few months because you think you’ve got it covered. If you really want to save for those goals, then you need to constantly keep your budget in mind, no matter how long you’ve been saving.

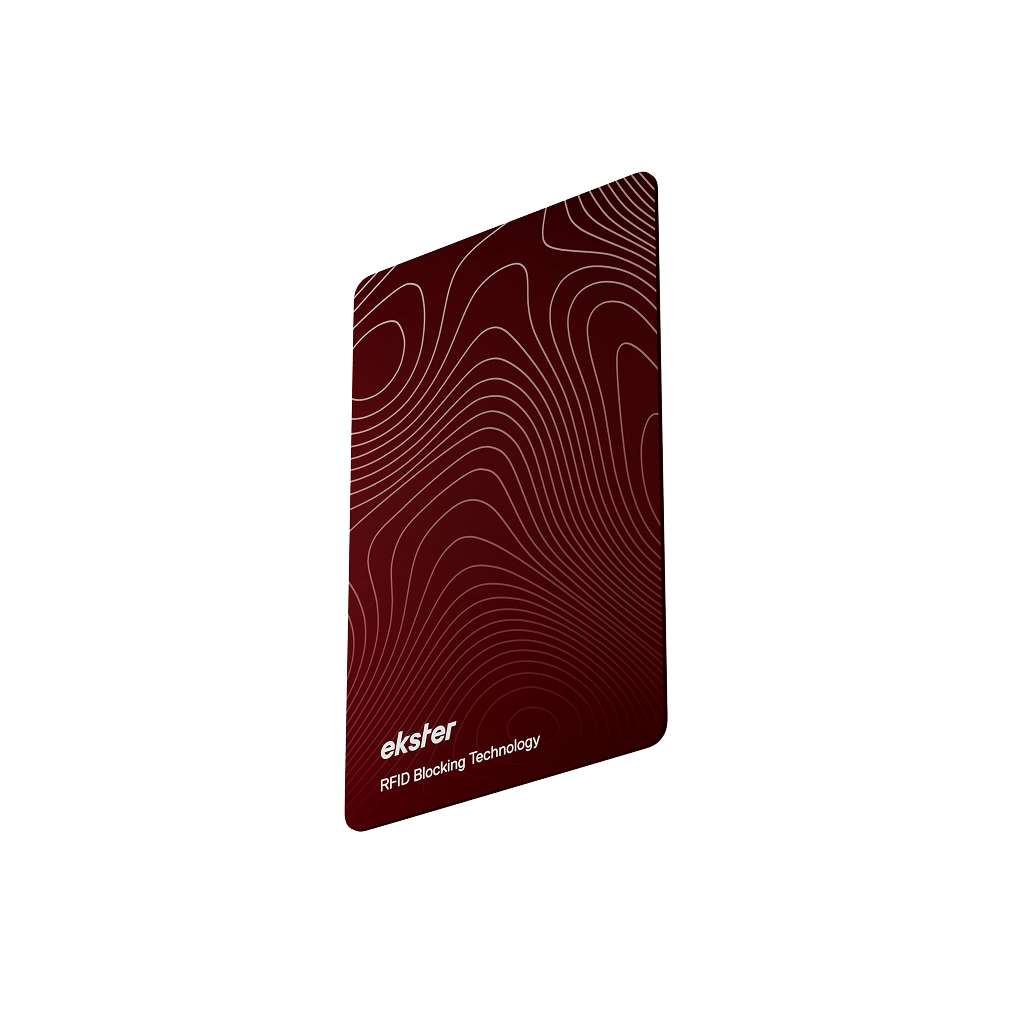

When it comes to finding the right wallet to fit your lifestyle and help you on your path to sticking to your budget, turn to Ekster. We have what you need to reach your dreams!